In 2024, fleet and equipment trends are playing a critical role in shaping the trucking industry. Carriers are facing tough decisions about expanding or contracting their fleets, as costs rise and economic pressures mount. In this blog post, we’ll dive deep into the state of fleet capacity, the trends in new truck orders, and the fluctuating prices of used trucks. Using data from the Q3 2024 Carrier Rate Report, we’ll explore how these factors are impacting carriers and the broader freight market.

One of the most notable trends in the trucking industry in 2024 is the significant decline in new truck orders. After years of strong demand, carriers are now pulling back on their investments in new equipment due to rising costs and economic uncertainty.

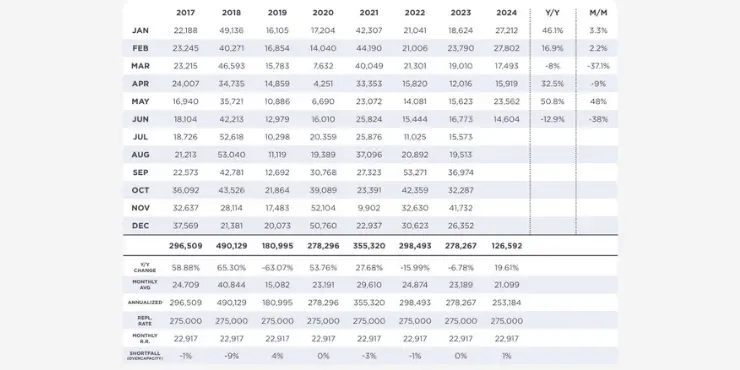

This figure offers a clear look at the fluctuations in monthly new truck orders over the past seven years. The data shows a sharp decline in orders during 2024, with a particularly steep drop in the months of April and June. For example, May saw a 38% decline from the previous month, reflecting the hesitancy of carriers to invest in new equipment amid rising operational costs and tighter margins.

This decline in new truck orders signals that carriers are being cautious about expanding their fleets. With the costs of fuel, insurance, and maintenance increasing, many carriers are choosing to extend the life of their existing equipment rather than making costly new purchases.

While new truck orders are slowing down, the used truck market is showing interesting trends as well. After a period of inflated prices due to supply chain disruptions and high demand, used truck prices are starting to stabilize, although they remain elevated compared to pre-pandemic levels.

This figure breaks down the average prices of used trucks over the past seven quarters, segmented by age (3 years old, 4 years old, and 5 years old). The data shows that prices peaked in Q4 2022, with a steady decline throughout 2023 and into 2024. By Q2 2024, the average price for a 3-year-old truck had fallen to approximately $58,694, down from a high of $103,709 just two years prior. Despite this decline, used truck prices remain higher than historical averages, driven in part by the reduced availability of new trucks and the long lead times associated with new equipment orders. For carriers looking to expand or refresh their fleets, the decision to buy used trucks has become more appealing, especially given the higher upfront costs of new trucks.

Fleet capacity is another critical factor influencing the trucking industry in 2024. As operational costs rise and demand fluctuates, many carriers are being forced to make tough decisions about whether to expand, maintain, or reduce their fleet sizes.

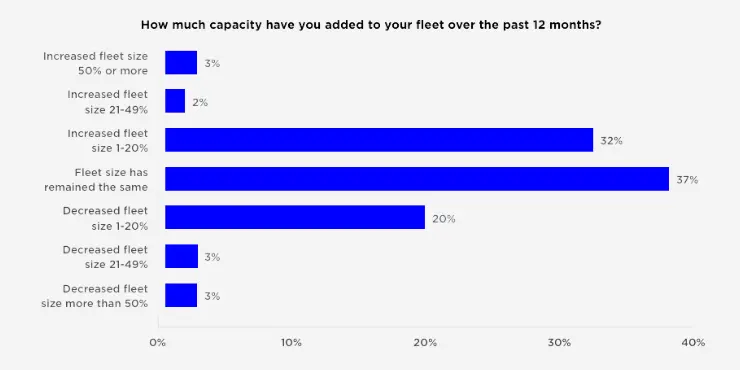

This figure tracks how carriers have adjusted their fleets over the past year. The data shows that 37% of carriers have maintained their fleet size, while 32% have expanded their fleet by 1-20%. Only a small percentage (3%) have increased their fleets by more than 50%, while another 20% have reduced their fleet size by 1-20%.

These trends suggest that while some carriers are still investing in growth, many are taking a more cautious approach, choosing to maintain their current fleet size or make only modest expansions. Rising costs and economic uncertainty are clearly influencing these decisions, with carriers prioritizing efficiency and cost management over aggressive growth.

This figure presents a comprehensive view of several key metrics across the last seven quarters, including the Tendered Load Volumes Index (OTVI), the Tender Rejection Rate (OTRI), and the National Truckload Index (NTI). It shows that while tender volumes increased slightly in Q2 2024, tender rejections dropped from previous highs, indicating that while there is demand for freight, carriers are increasingly accepting contracted loads rather than moving to the spot market.

The decline in tender rejections, paired with slower retail activity, suggests that while freight is still moving, it may be doing so at lower profit margins. Retailers are cautious about holding too much inventory, which can reduce the overall volume of freight moving through the system.

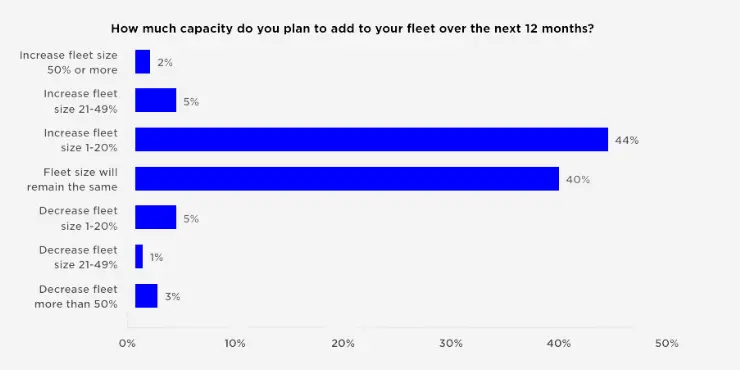

Looking ahead to the rest of 2024, carriers are optimistic about the future, despite the challenges they face. Many carriers believe that the worst of the economic downturn is behind them and are planning for fleet growth in the coming months. This figure highlights carrier expectations for fleet expansion over the next year. According to the survey data, 44% of carriers plan to increase their fleet size by 1-20%, while 40% expect to maintain their current fleet size. Only a small percentage (5%) anticipate reducing their fleets, indicating a general sense of optimism about the future.

Carriers are betting on a recovery in the trucking market and are preparing to expand their capacity to meet future demand. However, much of this expansion will depend on economic conditions and the ability of carriers to manage rising costs effectively.

In 2024, fleet and equipment trends are being shaped by a combination of economic pressures and strategic decision-making by carriers. The decline in new truck orders, the stabilization of used truck prices, and the cautious approach to fleet expansion all point to a trucking industry that is adapting to a challenging economic environment.

Carriers must remain flexible and strategic as they navigate these trends. By carefully managing their fleets and making informed decisions about equipment investments, carriers can position themselves for success in the months and years ahead.