In the second quarter of 2024, the U.S. trucking freight market faced notable challenges. The U.S. Bank Freight Payment Index report reveals a continued decline in shipment volumes and spending, mirroring a nationwide trend where consumers are spending more on services than goods. This shift has a direct impact on the trucking industry, which primarily relies on goods transportation. Let’s dive deeper into the latest data to understand how these changes are shaping the freight market.

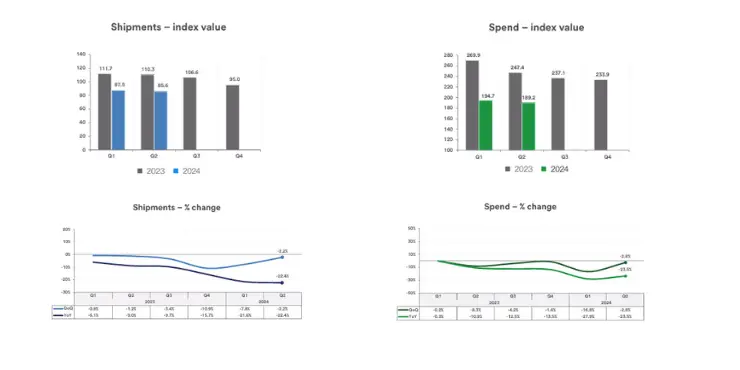

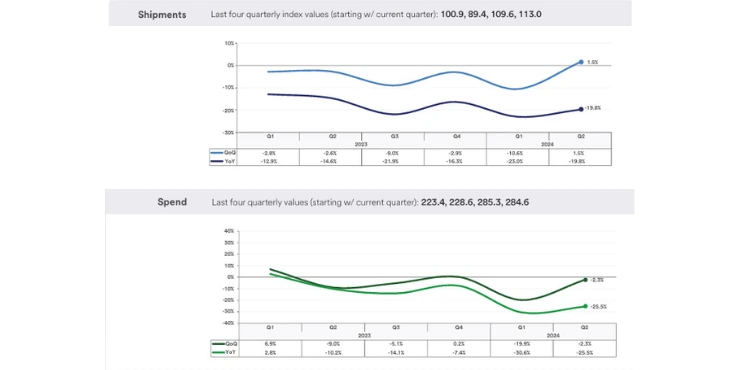

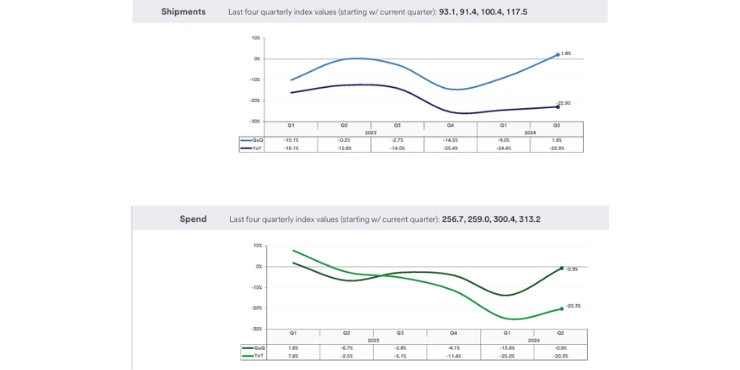

The Q2 2024 report shows a decline in both shipments and spending across the U.S. truck freight market. Compared to the first quarter, shipments decreased by 2.2%, while spending dropped by 2.8%. The reduction in diesel prices partly explains the drop in spending, as lower fuel costs reduce surcharges. However, reduced shipment volumes also play a significant role in this decline.

Currently, U.S. consumers are spending around 65% of their income on services rather than goods. This shift means fewer goods need to be transported, which impacts shipment volumes. This pattern has persisted for two years, contributing to a steady decline in shipment volumes, which directly impacts the revenue of trucking companies. This ongoing change shows no immediate signs of reversal and continues to challenge the industry.

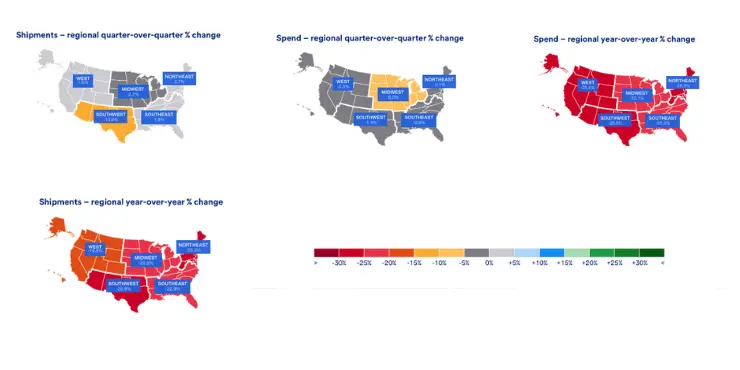

While the overall market is declining, regional data reveal slight increases in shipment volumes in the Northeast, Southeast, and West regions. The Northeast saw a 2.7% rise in shipments due to stable consumer spending on goods, while the Southeast and West regions showed 1.8% and 1.5% gains, respectively. These positive changes could hint at a potential bottom for the freight market.

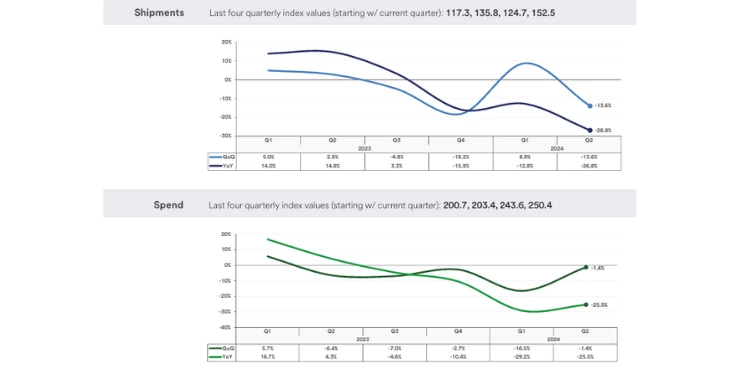

Conversely, the Midwest and Southwest regions faced continued downturns. The Southwest, in particular, saw a 13.6% drop in shipments—the steepest decline among all regions. This drop was driven by an excess of capacity, which lowered rates and dampened demand. The Midwest also declined by 2.7%, largely due to weak consumer demand and sluggish manufacturing growth.

Another critical factor impacting spending in Q2 was the drop in diesel prices. The average diesel price fell by approximately 12.5 cents from the previous quarter, leading to lower surcharges on shipments. Consequently, the national spend index declined faster than the shipment index. Although lower diesel prices are helping reduce costs, they haven’t been enough to offset the reduction in shipment demand. In regions like the Northeast, where spending only dipped 0.1%, freight rates remained stable. However, suppressed rates combined with higher operating costs are still pressuring the industry. Trucking companies are facing a “stagflation” effect, where lower volumes and high costs coincide, likely leading to further reductions in capacity as companies struggle to balance costs with declining demand.

The Southwest region faced a significant 13.6% drop in shipments, marking one of the most substantial declines among the five regions. This sharp downturn is due to an increase in capacity, which has led to lower freight rates, making it challenging for carriers to sustain their operations. This decline in shipments is consistent with a downward trend observed over several quarters.

The Midwest faced a 2.7% decrease in shipment volume, with a larger decline in spending due to weak retail demand and slow manufacturing growth. Meanwhile, the Northeast saw a 2.7% increase in shipments as steady consumer spending on goods remained stable. However, this region also saw a slight 0.1% dip in spending, reflecting an environment with lower rates and reduced fuel prices

The trucking industry is expected to face continued economic pressures in the coming quarters. The shift from goods to services, rising consumer debt, and high living costs are impacting freight demand. High operating costs and reduced shipment volumes mean that many trucking companies may need to reduce capacity to remain competitive. This trend could reshape the industry, leading to fewer, more resilient companies in the market.

While the national freight market is still struggling, the minor improvements in some regions may suggest a potential bottoming-out. If economic conditions stabilize, the trucking industry could experience a gradual recovery in shipment volumes. However, this recovery will rely on broader economic factors, including consumer spending patterns, inflation rates, and diesel prices.

The Q2 2024 U.S. Bank Freight Payment Index provides essential insights into the current state of the U.S. trucking industry. As consumer habits shift and economic pressures continue, the industry faces a complex landscape. While some regions are showing signs of resilience, others continue to experience significant declines.

By understanding these trends, trucking companies can better prepare for what lies ahead, adapting their strategies to manage costs, optimize routes, and make informed business decisions. As the industry evolves, staying informed on these economic and regional trends will be crucial for success.