The freight economy in 2024 is intricately linked with broader economic indicators, shaping the trucking industry in ways that are both predictable and surprising. As inflation, household debt, and consumer spending fluctuate, the trucking industry must adjust to these economic forces.

In this blog post, we’ll explore how these economic trends are influencing the trucking market in 2024 and what carriers can expect as we progress through the year.

One of the most significant economic pressures on the freight economy in 2024 is household debt. As inflation rates continue to influence consumer behavior, household debt has risen, particularly in the form of revolving credit (credit card debt). This creates a precarious situation for the freight industry, as consumer spending typically drives a significant portion of freight demand.

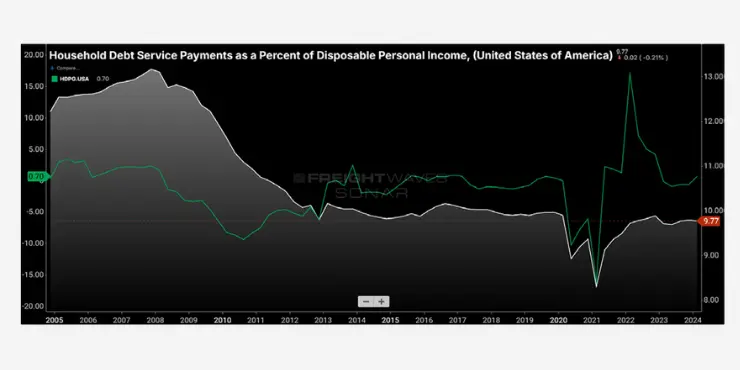

This graph from the report shows household debt service payments as a percentage of disposable income. The white line represents household debt levels, while the green line shows the year-over-year change in debt payments. Notably, debt service payments are at their highest levels since the COVID-19 pandemic, suggesting that consumers are under increasing financial strain. This is significant for the freight industry, as higher debt burdens typically lead to reduced spending on consumer goods, which in turn lowers freight volumes. With consumers having less disposable income to spend due to increasing debt, demand for freight services that cater to retail and consumer products could see a slowdown. Carriers should be prepared for potential shifts in freight demand as household finances tighten.

Retail sales serve as a bellwether for freight demand, particularly in sectors such as consumer goods, food and beverages, and durable goods. In 2024, retail sales have been impacted by inflationary pressures and shifting consumer priorities. According to the Q3 2024 Carrier Rate Report, retail sales fell on both a yearly and monthly basis in June, signaling a slowdown in consumer spending.

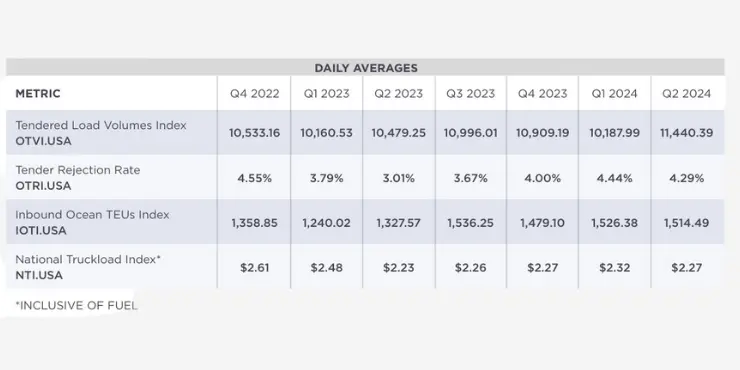

This figure presents a comprehensive view of several key metrics across the last seven quarters, including the Tendered Load Volumes Index (OTVI), the Tender Rejection Rate (OTRI), and the National Truckload Index (NTI). It shows that while tender volumes increased slightly in Q2 2024, tender rejections dropped from previous highs, indicating that while there is demand for freight, carriers are increasingly accepting contracted loads rather than moving to the spot market.

The decline in tender rejections, paired with slower retail activity, suggests that while freight is still moving, it may be doing so at lower profit margins. Retailers are cautious about holding too much inventory, which can reduce the overall volume of freight moving through the system.

Inflation continues to be a significant factor affecting freight costs in 2024. The rising cost of goods and services has increased operational expenses for carriers, particularly in areas like fuel, insurance, and maintenance. As inflation drives up the cost of doing business, carriers are forced to adjust their rates accordingly, passing some of these costs onto shippers.

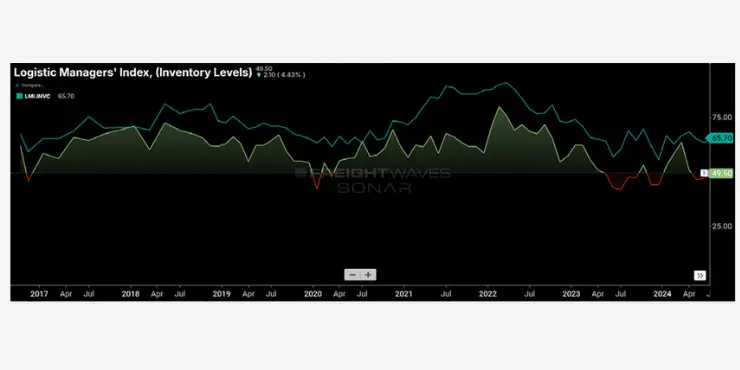

This figure tracks inventory levels across different sectors, with readings above 50 indicating expansion and those below 50 indicating contraction. Over the past few quarters, inventory levels have contracted as businesses adjust to economic uncertainty and inflationary pressures. This contraction signals a reduction in the amount of freight that needs to be transported, especially in sectors like retail and consumer goods.

The reduction in inventory levels can be attributed to a combination of cautious spending by businesses and rising costs due to inflation. For carriers, this means fewer loads to transport, potentially leading to increased competition for available freight.

In light of these economic pressures, carriers and shippers must be prepared for continued volatility throughout 2024. While some sectors of the freight economy remain resilient, others are more vulnerable to shifts in consumer behavior and economic conditions.

Carriers should focus on efficiency and flexibility to weather these economic challenges. Streamlining operations, reducing overhead costs, and maintaining strong relationships with shippers will be key to navigating the ups and downs of the freight economy in 2024.