The American Trucking Associations’ Highway Policy Committee recently concluded a crucial discussion at their ATA Management Conference & Exhibition, focusing on the evolving landscape of road user charges. With electric vehicles (EVs) increasingly common on roads, the committee deliberated on the most effective way to assess user fees for roads and bridges in an electrified future.

As electric vehicles gain popularity, they currently use road infrastructure without contributing to the federal motor fuels tax that supports American highways. This discrepancy has prompted the trucking industry to explore alternative methods of taxation that would ensure fair use of road infrastructure by all vehicles, including EVs.

Jana Jarvis from the Oregon Trucking Association highlighted Oregon’s approach to this challenge. The state’s vehicle-miles traveled (VMT) program, OReGO, alongside its weight-mile tax system, presents a complex model with its own set of challenges, including high evasion rates and collection costs.

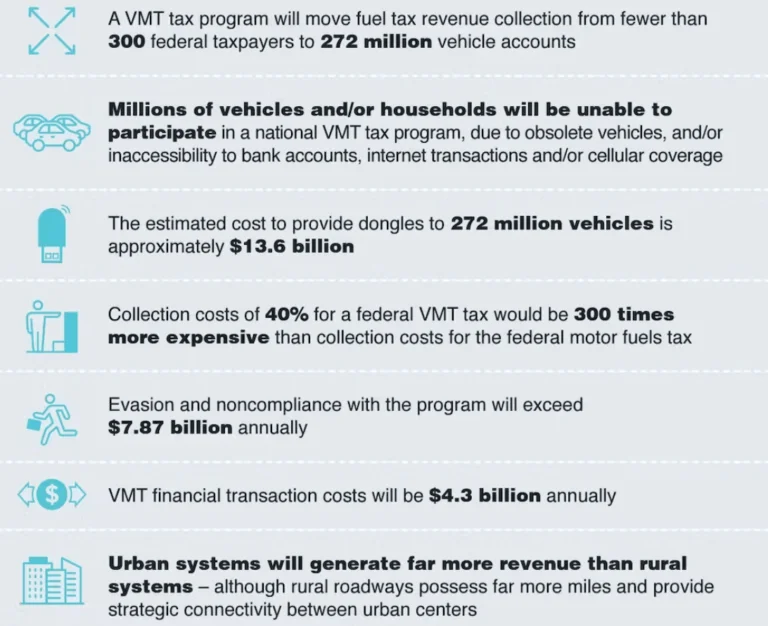

A significant concern with mileage-based fees, as discussed by Paul Enos of the Nevada Trucking Association, is the high cost of collection compared to the current federal fuel tax. Enos referenced a report indicating that replacing the fuel tax with a VMT tax could lead to exponentially higher collection costs.

The search for a fair and efficient road user charge system is complex. Any new system needs to protect taxpayer privacy, be cost-effective, and equitable across different vehicle types. However, as highlighted by Enos, achieving this balance with a VMT program seems increasingly challenging.

Tony Bradley from the Arizona Trucking Association pointed out that the gas tax system isn’t broken but rather suffers from a lack of political courage to adapt it to modern needs. He advocates for a model that taxes electricity for EVs, similar to the current gas tax, as a more straightforward and efficient solution.

Jim Newport, representing the Oklahoma Trucking Association, emphasized the high costs of collecting alternative road user charges. He advocates for a state-specific approach that doesn’t blindly follow existing models, underscoring the need for flexibility and innovation in addressing these challenges.

The trucking industry stands at a crossroads in determining how to fairly and effectively tax road users in an age of increasing vehicle electrification. As industry leaders and policymakers continue to debate the best path forward, the need for innovative, fair, and efficient road user charge systems becomes ever more apparent.